June 07, 2024

by David Goodale

How To Pick a Payment Processor?

(Slightly edited from video transcript for greater readability)

Key Takeaways

Hello, David here at Merchant-Accounts.ca. Today, we will discuss how to choose a payment processor. We'll cover the most important tips and considerations to help you select a reliable credit card processor for your business. Stay tuned, we'll dig in in one second.

Rates and Pricing Models

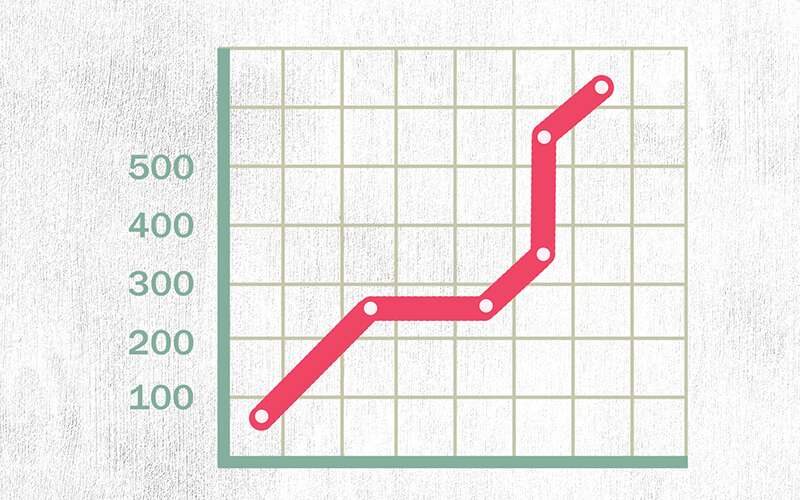

We're going to start with rates as we most often do. Rates are the first thing that most people think about for very obvious reasons. However, the pricing model that you get is important because if you're not on a good pricing model you may not be able to get the low rate you thought you would. You want to be on interchange plus pricing or a flat pricing model where your rate does not fluctuate. We have a lot of other content on the channel about the different pricing models. If you're going to seek out a quote and you aren't familiar with interchange, review some of that content, you can't negotiate effectively if you don't know what's fair and what the cost to the payment processor may be.

It also helps because you don't want to have unrealistic expectations. If you don't know what's a reasonable goal to try to achieve you'll not negotiate effectively. Maybe you say, hey, I want my processing fee to be 1.2%, but that's way below the processor's cost. That doesn't help either. Now this video isn't specifically about pricing and I don't want to go too deep into that topic, but please do review our content on pricing-specific topics because it helps you negotiate effectively. With that, I'm onto the next section.

Security Reserves

The next tip is about security reserves or holdbacks. Now, if you have a McDonald's franchise and you sell burgers, you know, people get their food within a minute because that's their claim to fame and somebody's very unlikely to think about the burger that they got a year ago and then do a chargeback a year later.

It's just not realistic. But that doesn't apply to all businesses. If you're a contractor that does commercial roofing, the deposit might be paid way in advance of the work and then after the job's done, it might not rain for another two months if you're in the heat of summer and a place doesn't get a lot of rain. But my point is that some types of merchant disputes, if they were to occur, don't happen right away.

The way that it works is, what I'm talking about is a dispute, called a chargeback. That's where a cardholder contacts their bank and says, hey, I paid for something, I didn't get what I was promised. I want you to forcibly reverse this transaction. The relevant point is that when that occurs, the cardholder has to get their money back. The payment processor has to immediately return the money to the cardholder, and if they can't recoup the money from the merchant, the payment processor is on the hook.

The way that's addressed is through security reserves. Some businesses could get a lot of chargebacks, and if those chargebacks pile up and the company's not able to have the financial wherewithal to return the money to the cardholder, the processors are the hook. This is generally speaking why security reserves exist. But in the world of payment processing, not all businesses are equal. That McDonald's franchise has no security reserved because there's no realistic future delivery risk. So, if you have the type of business with chargeback risk, if you can see it from the processor's perspective, hey, we do big tickets, it's not done for a while. Or our delivery window, like a cruise ship where people are booking their cruise way in advance, yeah, things could go wrong. Perhaps the cruise ship breaks down, people can't go on the cruise.

Security Reserves should be reduced over time

If you are the type of business that might have a security reserve, you want to ask some questions. Is your type of business something that the processor would normally need a security reserve for? Very importantly, will that reserve be reduced over time? By the way, it should. You should be able to get that commitment and get it in writing. Now, they won't say that it'll come down on this day, but what they should say is, if you keep your company running and it's in good financial shape meaning you're not taking losses and your chargebacks are not out of control, you're in good shape, we should be willing to do a review. You know, usually at six months or a year. You can even look for a commitment like if I have almost no chargebacks and I'm in good financial shape, could we reduce the hold back from 10% of sales to 5% of sales after six months and then 5% to eliminate it. After a year, you'll probably get some pushback like, yes, we'll need to do a review at that time, but it shows willingness.

If youre business takes a down turn security reserves may not be removed

It's very important to point out, and just for a quick aside here, in fairness to the processor, if something changed about your business and it wasn't doing very well or chargebacks, were out of control, don't expect your reserve to come down. Ultimately, even if you do get a security reserve, it's not a problem that you should have to live with forever. You want to make sure the processor that you're working with is going to be fair to you and treat you right when you get to that point.

Rate increases

The next point is rate increases. You should ask your potential processor what their policy is around rate increases. You know what that policy should be. We at Merchant-Accounts.ca don't do rate increases, while most processors do increase rates. I'm strongly of the position that it's very unethical to do so outside of fringe, very rare edge cases. I can think of one merchant we've worked with for a very long time that is based in Europe. What happened is that Visa and MasterCard changed the cost structure for debit cards issued in Europe.

The way that they changed it is the pricing this merchant was paying then became lower than our actual cost from Visa and MasterCard (interchange). We explained that to them and they were very willing to change it because we were being honest and transparent, it therefore wasn't a problem for the merchant. That particular example of a rate increase was extraordinarily unlikely in all our over 20 years in business. It's the only time I can ever remember raising a rate on a merchant. That's only also where a merchant is on flat pricing. If a merchant is on interchange plus pricing, that's where the payment processor says, hey merchant, for every transaction you do, we don't care what card type, we don't care how you do it, we're just going to take whatever the interchange cost is directly from Visa and MasterCard, and we are adding on our processing fee. For example, 0.25% or something approximate.

In that case, when interchange costs go up or down, the merchant's rate will go up and down according to interchange, but that's completely fair, transparent and reasonable. They should say very directly that they don't do rate increases. You want to listen to how they answer that question. They should be willing to put it in writing. If you can't get it in writing, I suggest finding a different payment processor.

Customer Support

The next topics to talk about are merchant support, customer support, and problem-solving. Generally speaking, early in a sales cycle is the honeymoon. That's when they're trying to win your business. Nobody can be more important than you, and they can't get back to your questions more quickly enough. However, once you've signed that contract, the honeymoon's over a few months on.

Do those people still care about your account? Do they still support it? It's really important and I will say a lot of business owners, not all business owners, but a lot of business owners don't value support enough until they need it. When people need answers like they need them now, what is it? What is it worth in that moment? But that's too late to start caring about it. Go back to the person who's quoting your account, ask them if will they remain available as a point of contact for any issues going forward. Will they stay responsive to every single point I just raised? The answer is they should, even in bigger organizations. I do get that some companies have dedicated sales teams and support staff, but really if you, if you're getting personalized service on the upfront of the sale, but then just like a call centre you can't have a dedicated contact afterward, it doesn't bode that well for ongoing support.

I don't like the word support. I like the word relationship or partnership. Someone who cares about you and is there and you can rely on. I think that's what you should ask for. You should seek that commitment. You should get it in writing.

Features

Another obvious criteria is technical features. I can't go too far down this track because there are so many features. Some examples include recurring billing, virtual terminal where you take card information over the phone, support for foreign or exotic processing currencies, e-commerce integrations with different shopping cart software. I can't tell you what your needs are, but you need to know what your business needs are today in at least the short and medium term. You want to make sure that this payment processor can support these things. I'll give you an example, PCI compliance, how your company handles and touches credit cards.

PCI is the payment card industry, data security standard, we have other content on the channel about that, including a podcast where I had a guest talk about it. If you want to make your life easy, as easy as possible from a PCI compliance perspective, can this perspective credit card processor support integration in such a way where you don't have to touch credit cards or let even a temporary record of a credit card number touch your server? Don't read too much into this example, it's just a point, but you need to make a list of the things that you need before you start reaching out to payment processors.

A good processor's going to support everything that you need and they're going to help make sure they'll complete the picture.

They should explain why they can do it. They should be guiding you through the process as much as is reasonably possible for a service provider to handle.

Funding

When are you going to get paid? Well, it's nice to know what your funding schedule's going to be. Do you want to get paid every day on daily funding or do you hate reconciling? You prefer to do it once a week. You should decide what funding schedule you want and ask them if you can be put on that funding schedule.

Contracts

A big one, contracts don't get stuck in them. Often overlooked don't get locked into a long-term contract. Now I want to be clear, there's nothing wrong with a long-term contract, especially if you've worked with your credit card processor for an ongoing period.

You can use a longer contract to negotiate a rate reduction in exchange for signing that longer contract. However, if you're working with a new service provider, I very strongly urge you don't get into a locked-in contract. At least if they want a locked-in contract, then seek a clause. Hey look, give me a six-month window to try you out. I want to know that I have an eject button for the first six months. Or better yet, just make it a month-to-month contract. just as an example, at merchant accounts.ca, by default, all of our contracts are month-to-month. If a client's worked with us for a while, they want to beat us up on the rate for a little bit. We'll say, hey, are you cool with signing a two-year fixed contract? By that point, we know them so well.

Conclusion

Everybody's happy, but don't do it at the outset. here it is for the summary. Get good rates. Be on a predictable and well-understood pricing model. We are guaranteed to get what you're promised. Don't just get a good rate promised to you. Make sure you get to pay the low rate that you were promised. Make sure you have as low a reserve or ideally no reserve if possible. if you do have a reserve, get a commitment from how quickly that will be reduced and what you would need to, what your performance would need to be to see that re-reserve either reduced or ideally eliminated. Again, on the support side, get a commitment for how quickly they respond to support issues. Find out if the salespeople helping you during the setup process will remain available to help you after you start processing.

To help with any issues that pop up, make sure that all of your technical requirements which you need to think about ahead of time are addressed. Don't get on a locked-in contract. With that, I think you'll have a pretty decent credit card processor. You could just work with us at Merchant-Accounts.ca. We work with Canadian, US, European, and UK-based businesses. You can visit us at Merchant-Accounts.ca. We'd be very happy to jump on a call to talk about your business. I hope this was helpful. Thanks for watching and have a nice day there. Bye now.

Need professional guidance?

Contact us for a free one hour consultation.

Can I Help Lower Your Processing Fees?

If you found this content helpful, will you give me the opportunity to quote on your business?

View Rates